-

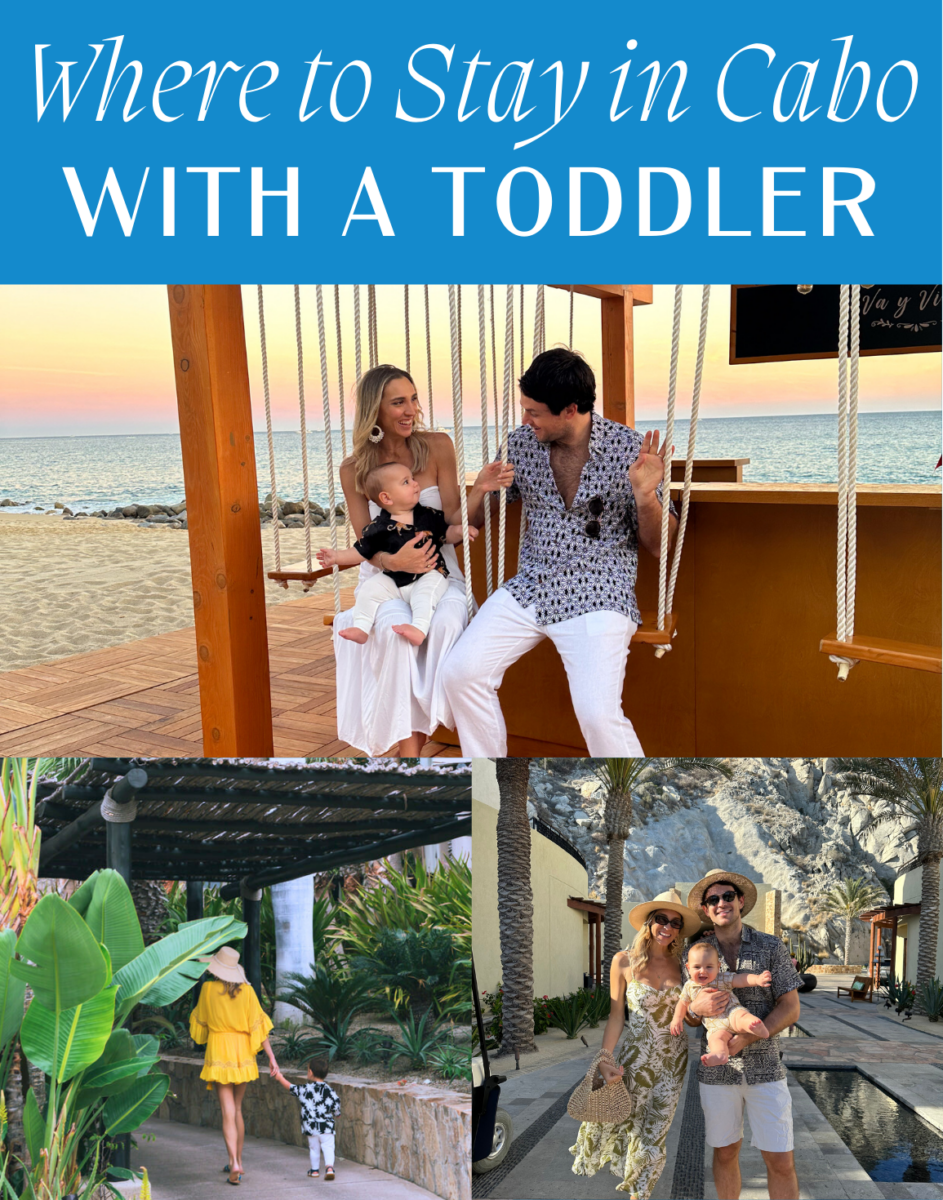

Where to Stay in Cabo with a Toddler – the Best Luxury Family Resorts in Los Cabos

When you’re planning a trip to Cabo as a family, picking the right place to stay is

-

The Most Romantic Hotels to Honeymoon in Italy

There’s a certain la dolce vita energy about Italy that makes it the ultimate honeym

-

Baby Travel Hacks: Tips on How to Travel Around the World with a Baby Like a Pro

The Best Expert Tips and Baby Travel Hacks on Traveling Around the World with a Baby ̵

most popular must-reads

-

Bora Bora vs. the Maldives : Which is better for a honeymoon?

If there’s one question I get ALL the time it’s : so which is better – B

-

The Top 10 Best Luxury Resorts in the World

I’ve spent the last 8 years blogging to you guys about the top luxury travel experie

-

The Ultimate First-Timer’s Travel Guide to Italy – Where Should You Go on a First Trip to Italy?

Planning a trip to Italy and unsure of where to even start? I’ve got you! When most

lifestyle posts

personal posts & stories

-

Harrison’s birth story – Navigating early labor, delivery, & our NICU experience

My husband and I found out I was pregnant on the same day we found out we got our house. W

-

6 Months into the Sleepless Dream of New Motherhood

A medical bill of different items for Harrison’s hospital stay earlier this year blares

-

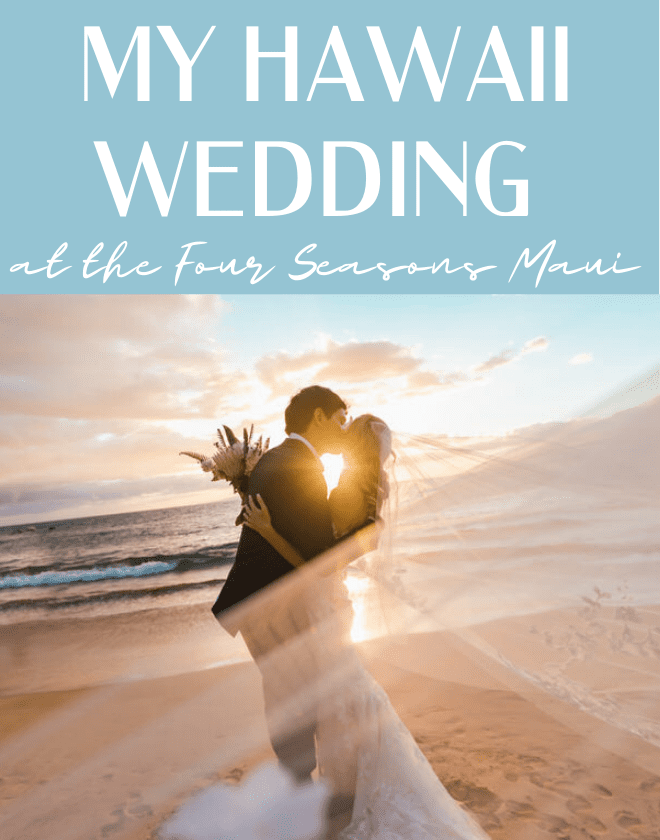

My Tropical Dream Wedding at the Four Seasons Maui at Wailea in Hawaii

When Kenny and I got engaged, we actually had no idea where we wanted to get married. We k